- Zanda

- Posts

- The January Kick-Off

The January Kick-Off

Kicking off the year with salary benchmarks in the making, smarter pricing conversations, and what’s coming next for finance leaders.

London | New York

Welcome to the January Edition of the Zanda Newsletter!

We’re kicking off 2026 with strong momentum!

Our next Salary Guide is in the works, and we’ve opened the survey for finance leaders to share their insights, so keep scrolling to find out more details.

In our first CFO Edit of January, we put the spotlight on Pricing and why it’s such an underused tool, sharing insights on how companies can leverage it better.

We’ve also got some exciting events lined up for February, and we’re offering free 1:1 sessions for founders, perfect for anyone approaching their first finance hire or unsure what their next finance step should be.

And in case you missed it, our latest Zanda blog dives into the rising importance of Interim M&A roles and why they’re more crucial than ever for growing businesses.

Let’s dive into what has happened this January 👇

We’d be super grateful, if you find these newsletters insightful to share them with your network. Also, remember to reach out if you have a Finance leader requirement or need any advice on how to elevate your finance function.

Enjoy this month’s edition and if there is anything you would like to see included, get in touch with [email protected]

What's included in this Edition?

Our Salary Guide is back! | Step 1: Survey

Back in 2024, we launched our first Salary Guide, built on thousands of insights from CFOs and finance leaders across the UK and the US. It quickly became the go-to benchmark of salaries, bonuses and equity, and it continues to be downloaded and referenced today.

Now, we are back building our 2026 Salary Guide to reflect what the real compensation market looks like across:

Funding stages (Seed - Series D & PE)

CFO & Senior finance roles

Locations including the UK, US and Europe

So if you are a CFO, VP of Finance, Finance Director, Head of Finance or Controller working in an ambitious business that is VC or PE-backed business, whether permanent, fractional or interim, please spare a few minutes to share your input and help shape the most up-to-date picture of finance compensation across startups and scaleups.

Our survey is completely anonymous, takes ~3 minutes to complete and you get the chance to win a £500/$1000 voucher as a thank-you.

The CFO Edit | Jenny Millar

In our January edition of The CFO Edit, pricing expert Jenny Millar, founder of Untapped Pricing, explores why pricing is one of the most powerful but consistently underused, levers for business growth.

Jenny highlights how pricing influences far more than revenue, shaping customer behaviour, retention, brand perception, and investor confidence.

Rather than being a one-off decision, pricing is framed as an ongoing, strategic capability that requires confidence, evidence, and cross-functional collaboration. The article unpacks common warning signs of weak pricing discipline, explains why many leaders hesitate to act, and shows how better alignment between finance, sales, and product teams can help companies capture the value they’re already creating.

Ultimately, it positions pricing not as a risk to manage, but as a growth opportunity hiding in plain sight.

Dive into the full blog to discover how thoughtful, evidence-led pricing can unlock growth you didn’t even know you had.

Q1 Events line-up | Get Your Calendar Ready

Last year, our CFO Masterclass tackled one of the most pressing questions for scaling finance teams: “What’s after Xero?”

We brought together three experts with first-hand experience across the full finance systems journey: David Tuck, Co-Founder and CEO of Mayday; and Rolf Buhler and Matt Benaron from VantagePoint. Together, they shared insights from cloud accounting to enterprise ERPs, and the next generation of AI-native tools.

Now, we’re bringing this discussion online. In our upcoming webinar, we’ll explore how the market has evolved since our last Masterclass, examine the latest trends, revealing which teams are moving toward AI-native solutions versus sticking with legacy platforms, and sharing real-world insights from those who have made the transition.

If you’re a CFO or a finance leader in the UK or US, this session is designed to give you practical, up-to-date insights to help you make smarter decisions for your finance architecture.

Make sure to follow us on LinkedIn to be the first to hear the full details of this event.

Founder’s 1:1s | Book in before slots run out

Bringing in financial leadership for the first time is one of the toughest decisions a founder faces. No matter whether you’re just starting out or scaling fast, it’s hard to know who to hire, when to hire, and what level of expertise your business really needs.

To help founders navigate this pivotal moment, Zanda is offering free 30-minute, 1:1 advisory sessions with our co-founder, Andrew.

These sessions are perfect for founders who are:

Approaching their first finance hire and unsure what “good” looks like

Wondering whether they need an accountant, Finance Manager, Head of Finance, or a CFO

Feeling that finance is becoming important, but aren’t clear on next steps

Make sure to book your slot as spaces are limited to ensure each session remains highly tailored.

Interim M&A Rewired | Zanda Blog

As M&A activity begins to recover, organisations are facing increased complexity, tighter timelines, and stretched leadership teams.

Rather than building permanent capacity, interim M&A specialists can come a flexible, high-impact solution, as these experienced deal professionals help businesses navigate cross-border complexity, manage multiple stakeholders, and maintain momentum without the cost, delay, or distraction of permanent hire, allowing core leadership to continue to keep focus at strategic level.

If you’re planning transactions in 2026, this blog explores why interim M&A expertise may be the missing link between deal intent and deal success.

Read the full post for a deeper look at where European deal momentum is building and how organisations are preparing to capture it.

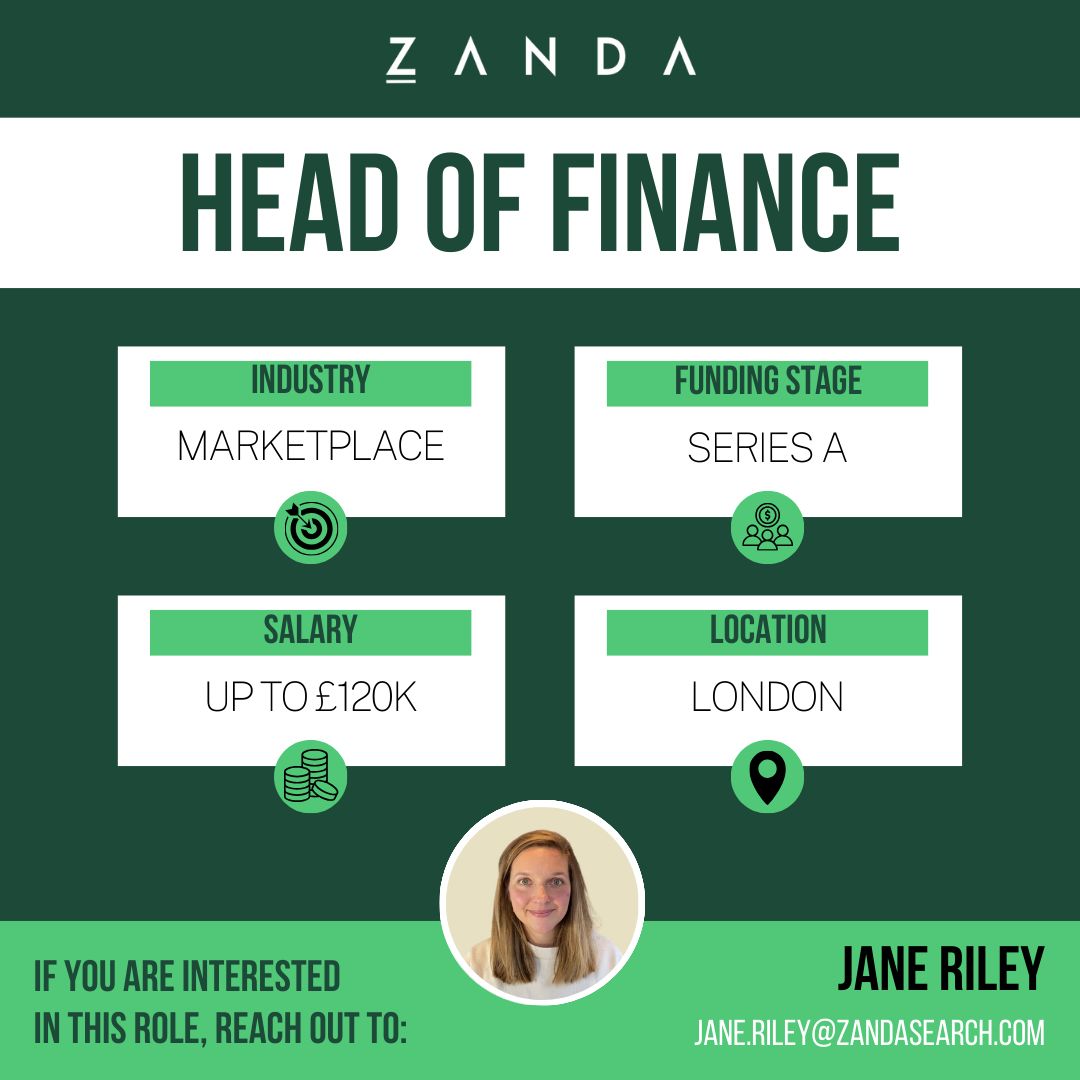

Current Opportunities

In this episode we have highlighted just a handful of our newest jobs, if you would like to apply for any of these roles please send an email to [email protected]

If you have a similar role you are currently recruiting for, register your vacancy here!