- Zanda

- Posts

- Scaling Through the Summer

Scaling Through the Summer

From summer events to standout conversations with finance leaders, here’s what’s been keeping us inspired, energised, and looking ahead.

London | New York | Manchester

Welcome to the July Edition of the Zanda Newsletter!

As July draws to a close, we’re reflecting on a month filled with sunshine, celebration, and some much-needed rest. The heat has certainly made its presence known, and whether you’ve been soaking it up or seeking shade, we hope you’ve found a moment to unwind.

Wimbledon brought its usual magic, with thrilling matches and strawberries-and-cream moments, reminding us of the beauty of this sport - powerful serves, nail-biting tie-breaks, and incredible athleticism on display.

We joined the nation in cheering on the Lionesses (what an incredible journey), culminating in their historic Women's World Cup win! Their determination and team spirit have been nothing short of inspiring.

The incredible drive and dedication of the athletes we’ve watched this summer has been nothing short of inspiring. With plenty of exciting things on the horizon, we’re feeling energised and ready to make the most of the months ahead.

Here’s to the final stretch of summer. We hope August brings you a little more sunshine, joy, and balance.

We’d be super grateful, if you find these newsletters insightful to share them with your network. Also, remember to reach out if you have a Finance leader requirement or need any advice on how to elevate your finance function.

Enjoy this month’s edition and if there is anything you would like to see included, get in touch with [email protected]

What's included in this Edition?

Venture Voices | Mountside Ventures

We had the pleasure of sitting down for a conversation with the co-founder of Mountside Ventures - Jon Steinberg, who works with founders across Europe to run better processes, close better rounds, and raise with conviction.

In our most recent episode of Venture Voices, Jon deep-dived into the art and science of fundraising. From navigating the shift between Series A and B to crafting a compelling, investor-ready narrative, Jon shared his insights on what truly resonates with VCs and how to spot those all-important buying signals. We also unpacked the common strengths and slip-ups founders face when scaling fast.

Make sure to read the full article or listen to the full podcast to get the complete picture of this discussion.

3rd Masterclass Completed | What’s next

In July we also hosted another brilliant Masterclass session with VantagePoint, successfully bringing together 50+ finance leaders to dive into the future of FP&A and the CFO’s evolving role as strategist and storyteller.

For the month of September, we are excited to announce our 4th CFO Masterclass: Navigating US Expansion, in partnership with Frazier & Deeter and Mishcon De Reya.

This hands-on session is built for growth-stage companies ready to take on the US market, covering everything from operational setup and compliance to preparing for a future listing. With the US offering unmatched access to capital and commercial opportunity, this Masterclass will arm finance leaders with the practical insights needed to scale smartly and compete confidently on new ground.

Make sure to sign up using the link below to secure your spot.

The CFO Edit | Rita Kale

From early-stage startups weighing their first feature launches to CFOs leading complex global growth strategies, the question is universal: how do you consistently spot, assess, and pursue the opportunities that will truly move the needle? Success isn’t about chasing everything, it’s about making confident, well-informed choices that align with your long-term vision.

In the latest edition of The CFO Edit, we welcome guest contributor Rita Kale, a seasoned CFO with global experience scaling healthcare companies like Roche, Foundation Medicine, and Graviton Biosciences.

In a world full of possibilities, the real challenge is knowing where to focus. In this article, Rita explores how to turn opportunity abundance into strategic clarity, why agility gives companies an edge, the critical role CFOs play in steering these decisions, as well as common traps leaders fall into and how to sidestep them with the right mindset and tools.

Future CFO Program | Zanda Graduate

A massive congratulations to Lucy Schofield, VP of Finance & Operations at ThisThat, on completing the Future CFO Programme with GrowCFO!

The FutureCFO programme is designed to accelerate the development of high-potential finance leaders, and ensures that the candidates we promote are not only CFO-ready, but fully equipped to thrive in the role from day one.

Delivered by GrowCFO, the UK’s leading finance leadership development platform, the programme supports first-time CFOs as they step into a top finance role. It provides structured, real-world training and mentoring to help new CFOs build confidence, strengthen their strategic thinking, and develop their leadership toolkit.

Reach out to our team if you want to learn more about the Future CFO programme.

Wimbledon | Grass, Grit, Glory

In July, we had the pleasure of attending Wimbledon, soaking up the sunshine, the atmosphere, and of course, some world-class tennis. Between thrilling rallies and perfectly timed aces, it was a brilliant reminder of how sport brings people together.

Amid the excitement, we also found time for some meaningful conversations. The real value we bring isn’t just in recruitment, but in being a trusted partner, someone who can offer clear, objective advice on what kind of finance leader a business needs now, and what it will need to succeed in the future.

Stepping away from the usual routine to connect in a different setting was more than just refreshing, it gave us space to reflect, recharge, and return with fresh perspective.

Whether you were backing the underdogs or rooting for the favourites, we hope you enjoyed every second of the matches.

July Fundraising Report | UK and New York

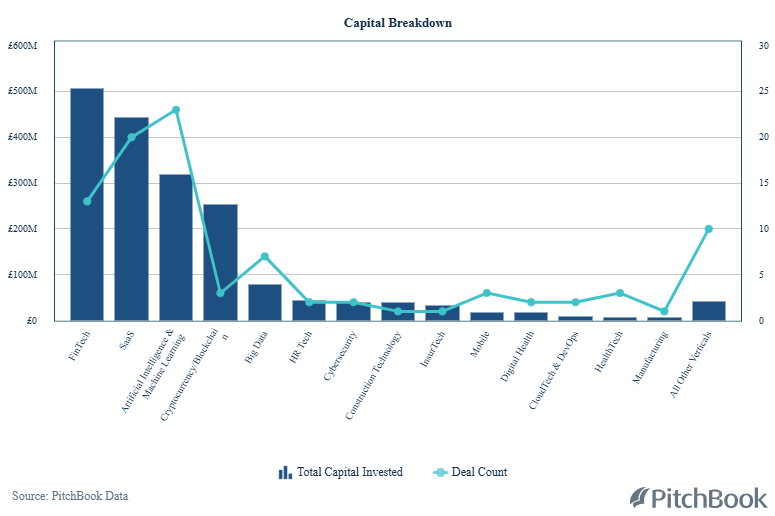

In the UK, funding in July has been the highest we have seen for this year so far, with the total capital invested sitting at an astonishing £1.27 billion!

Three industries stood out as investor favourites in July. SaaS led the way, attracting nearly £590M in funding, followed closely by FinTech with £566M. Cryptocurrency and Blockchain rounded out the top three, bringing in just under £490M.

It’s also worth highlighting AI & Machine Learning, not the highest in total funding, but the most active by deal count, with 15 transactions closed over the month, signalling strong and growing interest in the space.

In New York, Q3 started with a big bang, with a staggering $1.2 billion of capital being invested with the help of 183 investors.

In July, FinTech came out on top, pulling in over $670M as investor interest in financial innovation continues to hold steady. SaaS followed with $587M, reflecting the ongoing appeal of flexible, scalable software models. AI & Machine Learning took third place with $421M, as more companies look to integrate smarter, more automated solutions into their operations.

At the end of each month, we produce a more in-depth article highlighting the companies that have raised the most as well as the top players when it comes to investors, both across the UK and New York in the Seed - Series B tech space.

Make sure to check out our next month edition for insights covering July.

Current Opportunities

In this episode we have highlighted just a handful of our newest jobs, if you would like to apply for any of these roles please send an email to [email protected]

If you have a similar role you are currently recruiting for, register your vacancy here!