- Zanda

- Posts

- Kicking off Q2 the right way

Kicking off Q2 the right way

New features, new masterclasses and global conversations

London | New York | Manchester

Welcome to the April Edition of the Zanda Newsletter!

April was a busy month for us! We have been busy planning new CFO roundtables, planning the launch of our masterclasses, recording a new VC podcast as well as even being invited to appear on a very exciting New York based podcast. Let’s break it down.

Next month, we are bringing CFOs together across London and Manchester for a series of exclusive roundtable events. Scroll down to find out the next dates for our events.

We are excited to launch our latest Venture Voices episode featuring Nicholas Wijnberg from Lorimer Ventures, who shared his insights on topics of when to hire a finance leader, what key traits to look for, as well as the future of SaaS, AI’s impact on finance, and what makes a founder truly investable.

We have updated the dates for our upcoming CFO Masterclasses Series, so be sure to check those changes below.

We are thrilled to share that our co-founder Dav was invited to appear on The Growth-Minded CFO podcast to share his perspective on What Makes a Great CFO in 2025.

Scroll down to read all of this plus a standout testimonial from a recent fractional Finance Director placement.

We’d be super grateful, if you find these newsletters insightful to share them with your network. Also, remember to reach out if you have a Finance leader requirement or need any advice on how to elevate your finance function.

Enjoy this month’s edition and if there is anything you would like to see included, get in touch with [email protected]

What's included in this Edition?

Venture Voices | Lorimer Ventures

In April, we had the pleasure to talk to Nicholas Wijnberg, the Founder and General Partner of Lorimer Ventures.

In this conversation, Nicholas dives into some of the most pressing questions early-stage founders face, from when to hire a finance leader and what traits to look for. He also explores the importance of go-to-market expertise, particularly in SaaS businesses where distribution can make or break growth, and discuss what truly makes a founder investable beyond the pitch deck.

Lorimer Ventures takes a hands-on, expert-led approach to supporting founders. It has a core team of experienced startup builders, as well as a robust network of venture partners and investors. Lorimer Ventures helps their portfolio companies scale through focused support in hiring, go-to-market strategy, and FP&A advisory.

CFO Masterclasses Series | Coming soon

There are only a few spots left on our first Masterclass in May! The dates have changed so if you are interested in attending make sure to check the correct dates below.

Check out the dates and discussion topics for our upcoming masterclasses:

06/05 | The future of Finance data and AI - How to structure and streamline data flows to create a foundation to build on AI capabilities upon

18/06 | The Art of Fast Close - How to accelerate your working day timetable so your business closes between day 3 – 5.

15/07 | Shaping the Next Era of FP&A - What does the future of FP&A look like, what are the key people, process and technologies required.

Don't miss out on this unique opportunity to level up your financial expertise by signing up below.

The Growth-Minded CFO | What Makes a Great CFO in 2025?

This month, our co-founder Dav Masaon had the amazing opportunity to be featured on The Growth-Minded CFO podcast, hosted by Lauren Elizabeth Pearl and Alex Louisy.

The topic of discussion revolved around what makes a great CFO in 2025 and the conversation focused on how the ideal finance leader evolves as startups grow and evolve.

Dav highlighted that timing to hire a CFO is crucial, as if it’s left too late, the company risks being unprepared for investor demands; if you hire too early and the CFO may be underutilised. Founders should consider their runway, growth ambitions, and personal finance expertise when making this decision.

During the discussion, Dav also reflected on how the CFO role has transformed: modern CFOs are strategic partners, not just number crunchers. CFOs must be data-savvy, strong communicators, and capable operators who help steer the company’s direction.

Whether you’re navigating early-stage scaling or preparing for major fundraising, understanding these dynamics is critical.

Access the podcast now »

Roundtables | Upcoming events

CFO Roundtables are back in London and Manchester! Check out the dates below to make sure you get a seat.

If you are a CFO looking to expand your knowledge, network and create meaningful connections with other experienced executive leaders, check out our upcoming roundtables events and join us for a conversation.

Join us for our next events in:

London Dinner Club | 14th of May | 6pm

Manchester Breakfast Club | 22nd of May | 8:30am

Reach out to Andrew if you are interested in attending the London roundtable, or to Nick if you want to attend the Manchester roundtable.

Reserve your spot and take time to focus on what matters most.

April Fundraising Report | UK and New York

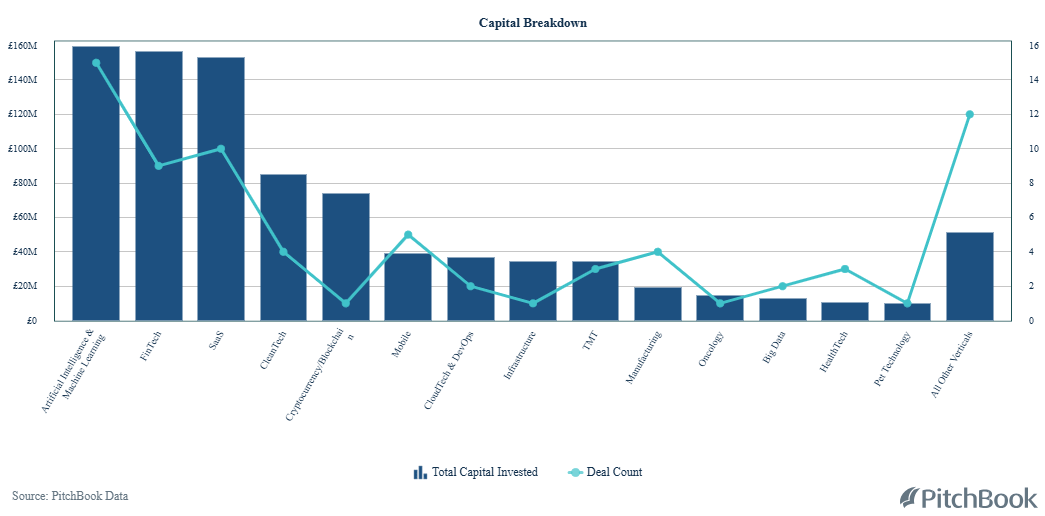

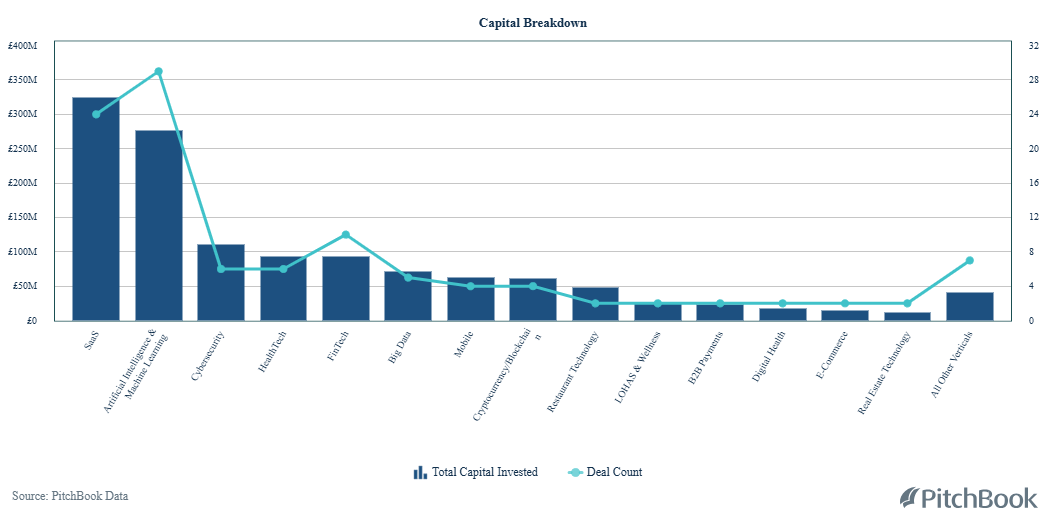

In April, the UK saw 38 companies receive investment from 164 investors, across Seed, Series A and Series B funding stages, with the total capital invested being just under £385M.

This month, there was a clear leadership board with the top 3 industries being AI & Machine Learning, Fintech and SaaS. The capital invested between these 3 industries was very similar, each industry receiving just under £160M in investment.

CleanTech and Cryptocurrency/Blockchain were the runner-ups, receiving £85M and £73M in funding, respectively.

In New York, 53 companies successfully secured funding from 254 investors, with the invested capital totalling £640M.

In April, SaaS was the most invested industry, obtaining £324M in capital . AI & Machine Learning take a strong second place, having secured £276M in investments across 29 deals.

Cybersecurity, HealthTech and FinTech complete the top 5 industries, with Cybersecurity receiving £111M, and HealthTech and Fintech both securing £93M.

At the end of each month, we produce a more in-depth article highlighting the companies that have raised the most as well as the top players when it comes to investors, both across the UK and New York in the Seed - Series B tech space.

Testimonial

From fundraising to global expansion, experienced fractional finance leadership brings the agility and expertise fast-growing startups need.

We were thrilled when Praetura Ventures connected us with James Burch, Co-Founder of Decently, as we knew we had the fractional network available to support their growth!

At Zanda, we specialise in finding fractional finance talent for high-growth startups who can:

Build robust, investor-ready financial models

Communicate confidently with stakeholders

Gain clarity and control over your numbers

If you’re scaling and want to make sure your finance function is future-ready, please reach out to our team who will be happy to schedule an introductory call.

Current Opportunities

In this episode we have highlighted just a handful of our newest jobs, if you would like to apply for any of these roles please send an email to [email protected]

If you have a similar role you are currently recruiting for, register your vacancy here!