- Zanda

- Posts

- Igniting connections and sparking conversations

Igniting connections and sparking conversations

This edition is packed with insights, expertise and invitations.

London | New York | Manchester

Welcome to the February Edition of the Zanda Newsletter!

In this edition we’re kicking things off with an exclusive interview featuring 25 Madison, where we dive into their unique venture model and strategic approach to investment.

We are excited to share a little glimpse behind our first London Roundtable event of the year and sharing upcoming dates for the next roundtables - don’t miss your chance to join the upcoming conversations!

In the second edition of The CFO Edit, we look into how making the jump from VP of Finance to CFO is one of the biggest transitions in a finance leader’s career. Our guest CFO Tanya Andreev Kaspin shares key skills, mindset shifts, and leadership qualities needed to make the leap

This month our founders asked our finance community to share thoughts and perspectives on how the next 12 months are shaping up, including the opportunities and challenges that may lie ahead. Scroll down to find the results from our engaged network.

We have also included a snapshot of February’s funding landscape in the UK and New York, as well as a round up of our top job opportunities.

Let’s dive right in below!

We’d be super grateful, if you find these newsletters insightful to share them with your network. Also, remember to reach out if you have a Finance leader requirement or need any advice on how to elevate your finance function.

Enjoy this month’s edition and if there is anything you would like to see included, get in touch with [email protected]

What's included in this Edition?

Venture Voices | 25madison

🎙️ For the first episode of Venture Voices in 2025, we sit down with Jaja Liao, Principal at 25madison, a venture studio and early-stage fund focused on pre-seed and seed investing in NYC.

In this conversation, Jaja offers valuable insights into 25madison’s investment strategy, the role of AI in private equity-backed companies, and what makes a founder stand out in a pitch.

What keeps 25madison apart from traditional VC firms? The firm’s key differentiator is deep collaboration with multiple Private Equity firms, which allows them to help portfolio companies with go-to-market strategies and secure customers through PE-backed networks.

Jump into this article to understand why now is an opportune moment for companies to target PE firms and the importance of a clear "why you?" narrative when pitching.

CFO Roundtable 2025 | Igniting connections

We had an incredible kickoff to our 2025 CFO Roundtables earlier this month 🎉

It was great to reconnect with our network, sharing insights and experiences on the challenges and opportunities of being a startup CFO.

A huge thank you to all the CFOs who joined us, and a special shoutout to our VC guest, Jonathan Lerner from Smedvig Ventures, for bringing your fresh perspective to the discussion.

You can register your interest in attending one of our roundtable events here.

We look forward to seeing you at our next roundtables:

March 12th - 6PM | Manchester

March 20th - 6PM | New York

March 25th - 8:30AM | New York

Reach out to Ines if you wish to secure a spot at one of our upcoming roundtables.

The CFO Edit | Second edition

For this month's episode of The CFO Edit, we have invited expert CFO Tanya Andreev Kaspin to share her knowledge on how to step up into the C-Suite.

Making the transition from VP Finance to CFO is one of the most challenging career moves for finance leaders. Learn from our guest CFO Tanya Andreev Kaspin on how to shift from financial operator to strategic leader, develop big-picture thinking, and master the key skills needed to thrive as a CFO.

Tanya is an Executive Operator with over 20 years in public and private tech companies, specializing in global scaling, IPO leadership, M&As, and post-merger integrations. She built and scaled high-performance teams from the ground up and took her last company public as a CFO. In 2024, she founded Amtella Advisory, whose mission is to provide financial advisory to tech start-ups and empower aspiring first-time CFOs through personalized mentorship.

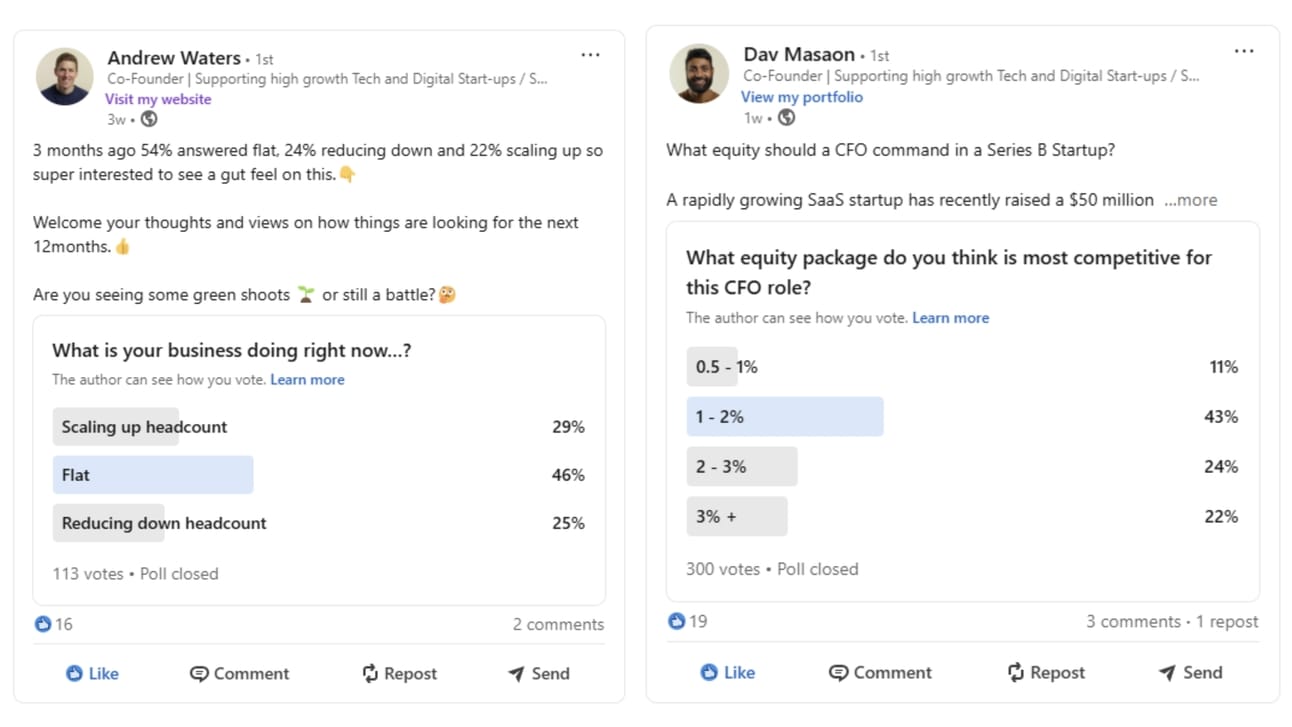

Founders Feature | Market Outlook & CFO’s Equity

Our founders have been busy on LinkedIn engaging with their network to enquire about what the market looks like so far in 2025.

Andrew’s network provided us with their headcount plans for this year. He ran this poll twice to compare results over 2 periods of time. Here is what they said:

3 months ago, 54% answered their team size would remain flat, 24% said they were reducing down headcount and 22% were scaling up.

This month, 48% answered remained flat, 22% said reducing headcount down and 30% said they were scaling up.

It seems that compared to the last quarter, there is certainly more optimism and momentum to hire, however there is not yet big momentum behind this.

Over in New York, Dav asked his network which equity percentage should a CFO of a Series B business be receiving, considering that the CFO will play a critical role in guiding the company through its next phase of growth, including potential international expansion. Here’s what his network thought:

43% of respondents felt that 1% to 2% is a fair compensation when it comes to equity.

24% of respondents think that equity compensation needs to be between 2% and 3%, tightly followed by 22% of those who consider that equity needs to be more than 3%.

If you aren’t already following our co-founders on LinkedIn, make sure to connect with them to keep up with their updates.

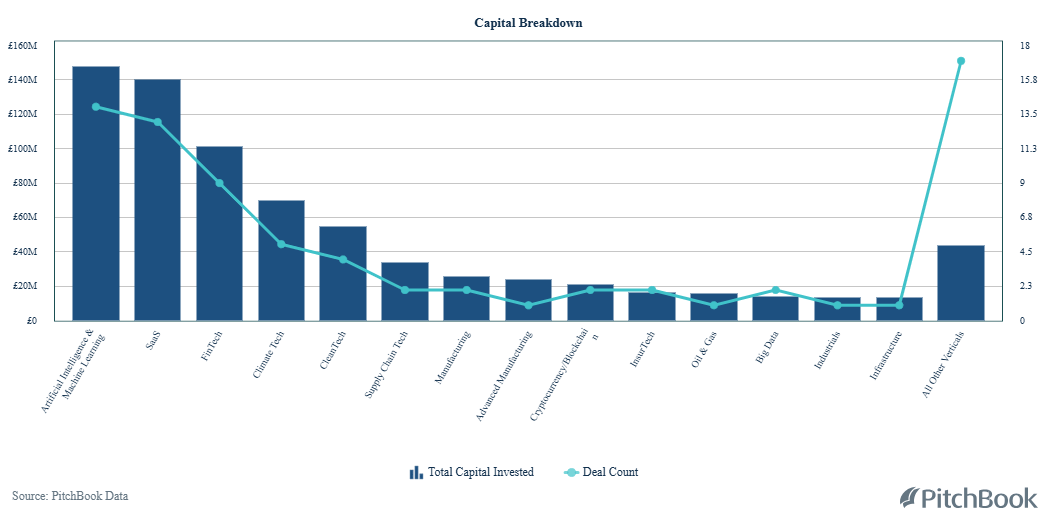

February Fundraising Report | UK and New York

In February, 35 deals took place in the UK’s Seed to Series B tech space.

AI led the way with over £140M in investment, closely followed by SaaS at £140M and FinTech at £100M. ClimateTech and CleanTech also saw strong backing, bringing in £70M and £55M, respectively.

It's no surprise that AI and SaaS are attracting so much investor interest - both have broad applications across industries like healthtech, finance, and data, making them key drivers of innovation.

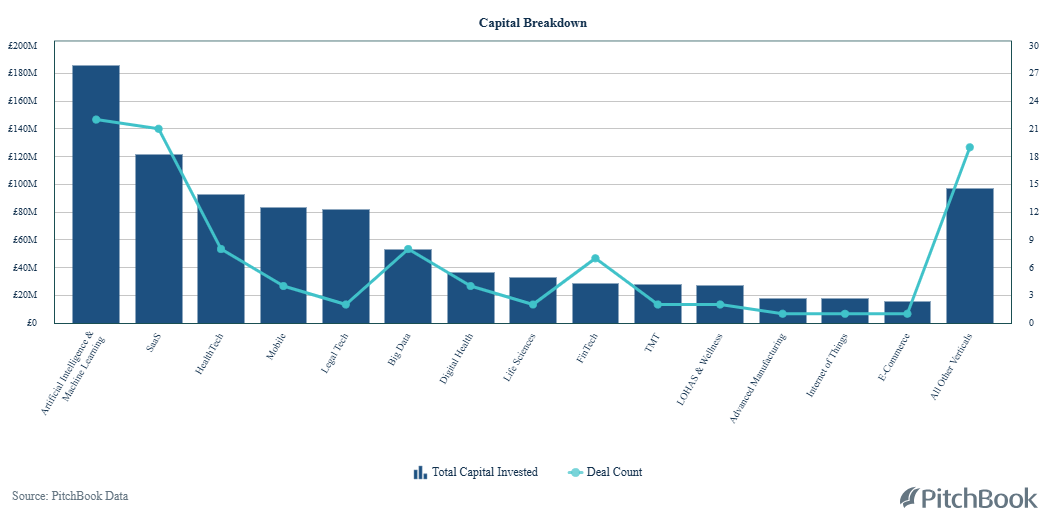

New York’s funding landscape was busy in February, with 50 deals closed - more than in the UK.

When it comes to the top five industries, New York follows a similar trend, with AI and SaaS leading the way, however with a bigger gap in investment size. AI secured over £180M in funding, while SaaS brought in just over £120M.

Fintech, Mobile and LegalTech received similar investment values, ranging between £80M and £90M.

Overall, February was a big month for tech investment in both the UK and New York, with AI and SaaS leading the way. As funding trends shift and new players enter the scene, we are excited to see what March brings.

Stay tuned for next month’s update!

Current Opportunities

In this episode we have highlighted just a handful of our newest jobs, if you would like to apply for any of these roles please send an email to [email protected]

If you have a similar role you are currently recruiting for, register your vacancy here!