- Zanda

- Posts

- Onwards & Upwards: Launches, Returns & Recaps

Onwards & Upwards: Launches, Returns & Recaps

What's new for Zanda in 2025 and what is making a welcome return?

London | New York | Manchester

The first month of the year has set the tone for an exciting 2025!

We have seen a significant increase in the number of Founders and VCs wanting to immediately kick off or start conversations about kicking off a CFO / FD search in the coming weeks. There is more confidence to be able to grow/raise capital and more momentum with recruitment compared to 2023 & 2024.

In addition to busy books, we have been busy planning all of our roundtable events for 2025! We’re back across London, Manchester and New York offering dynamic discussions between like-minded finance professionals.

January saw the launch of our newest blog feature The CFO Edit, a fresh monthly edition written by seasoned finance leaders, offering their perspective on finance, strategy, and leadership in startups. And as we prepare the next episode of Venture Voices, we reflect on all the episodes we’ve produced so far.

We hope your January has been productive and you are as excited as we are for the year ahead!

We’d be super grateful, if you find these newsletters insightful to share them with your network. Also, remember to reach out if you have a Finance leader requirement or need any advice on how to elevate your finance function.

Enjoy this month’s edition and if there is anything you would like to see included, get in touch with [email protected]

What's included in this Edition?

Introducing: The CFO Edit

Welcome to The CFO Edit, our new column spotlighting expert insights from high-profile CFOs and senior finance leaders, with the goal of contributing to our finance leader community.

Each article in this series will explore critical financial topics, from navigating market trends to mastering financial strategy, offering unique perspectives on key financial topics.

Authored by seasoned finance professionals, we hope The CFO Edit will become your go-to for thought-provoking commentary and advice to stay ahead in the ever-evolving world of finance.

You can read our first edition here, written by Carl Pombar, who shared his insights on how to manage cashflow.

In his article, Carl emphasizes the critical importance of cash flow management for CFOs, particularly in early-stage and VC-backed companies, and provides strategies to improve financial outcomes, as well as common pitfalls to avoid when it comes to cashflow management.

CFO Roundtables are back!

Over the course of 2024, we proudly hosted approximately 20 roundtable events across New York, London, and Manchester 🙌 In 2025 we are aiming to surpass this number and we can’t do it without you!

Our CFO roundtables have gathered nearly 200 leading finance professionals to share their challenges, nurture their network and expand their knowledge!

If you haven’t attended yet and would like to secure your spot this year, let us know in the poll below which city and level of seniority you would like to attend.

If you are interested in a roundtable event, which location would you attend? |

We look forward to connecting soon!

Venture Voices 2024 Recap

Venture Voices is a podcast series launched by Zanda in 2024, featuring exclusive interviews with leading venture capitalists from the UK and US.

Last year, we had the opportunity to speak to 5 featured guests, each bringing a unique perspective on the venture capital world, from funding strategies to the key traits that drive successful startup scaling.

In the inaugural episode, Olivia O’Sullivan from Forum Ventures shared insights into their investment strategies, the importance of assessing startups' financial health, evaluating partnerships, and nurturing founder growth. Read now.

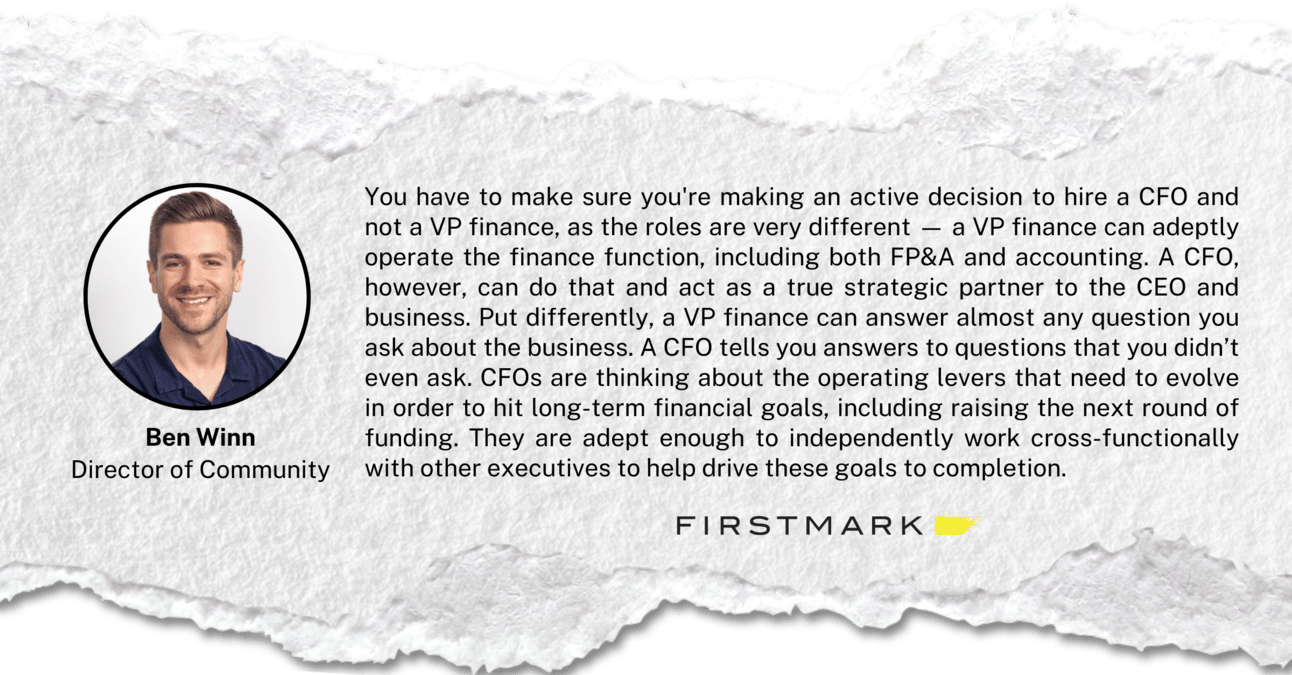

Our second guest - Ben Winn, Director of Communities at FirstMark, provided insights into the firm's platform approach and how they support founder growth. He discussed FirstMark's criteria for assessing potential platform partners and the value they place on metrics. Read now.

Jessica Jackson, Investment Manager at Praetura Ventures, discussed the venture's focus on supporting businesses in the North of England and how Praetura is contributing to the growing tech ecosystem in the region. Read now.

Stan Williams, Partner and Director at Fuel Ventures, shared his experience in investing in early-stage European technology companies. Stan also delved into Fuel Ventures' investment strategies, growth metrics, and post-funding support. Read now.

Our most recent guest featured in the December edition - Laura Willming, Head of Talent at Octopus Ventures, discussed company growth and founder challenges, as well also emphasizing the critical role of the CFO. Laura offered insights into effective board dynamics, drawing from her experience supporting one of Europe’s prominent VC portfolios. Read now.

You can explore these conversations in more depth on our dedicated Venture Voices page here.

Stay tuned for the next Venture Voices - we have 3 New York VC episodes being recorded as you read this, with the first to be published next week so you definitely don’t want to miss out!

Blog : How to Assess if Your Startup is Ready for a CFO

Is Your Startup Ready for a CFO?

Deciding when to bring on a Chief Financial Officer is a critical step in your startup's growth journey.

A seasoned CFO can elevate your financial strategy, prepare you for major milestones, and meet rising investor expectations. However, hiring one too early—or when it’s not yet necessary—can be a costly misstep.

Our recent article dives into the first section of our CFO Hiring Playbook and explores what you need to consider when evaluating if the timing is right. From assessing your financial maturity and growth trajectory to understanding how investor expectations evolve as you scale, we break down the key factors that influence your decision.

Fundraising at a glance: UK and New York

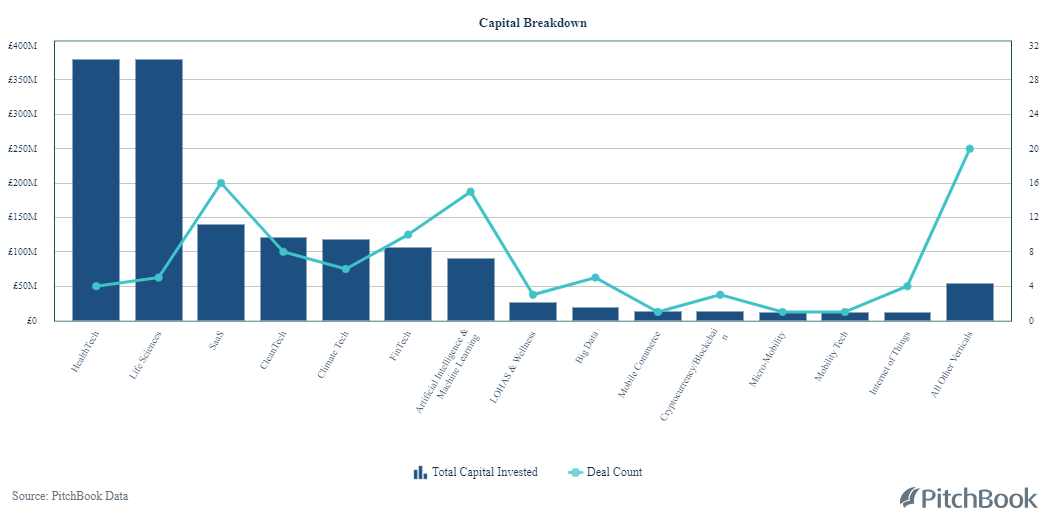

The UK investment scene in January was all about big money in HealthTech and Life Sciences. With both sectors pulling in over £300M each, it’s clear that investors are backing fewer but much larger deals—likely a reflection of the steep costs tied to biotech innovations and healthcare advancements.

Meanwhile, SaaS and AI saw more deals overall, but with lower total investment, suggesting these sectors require less capital per company and offer scalable solutions that attract a broader pool of investors.

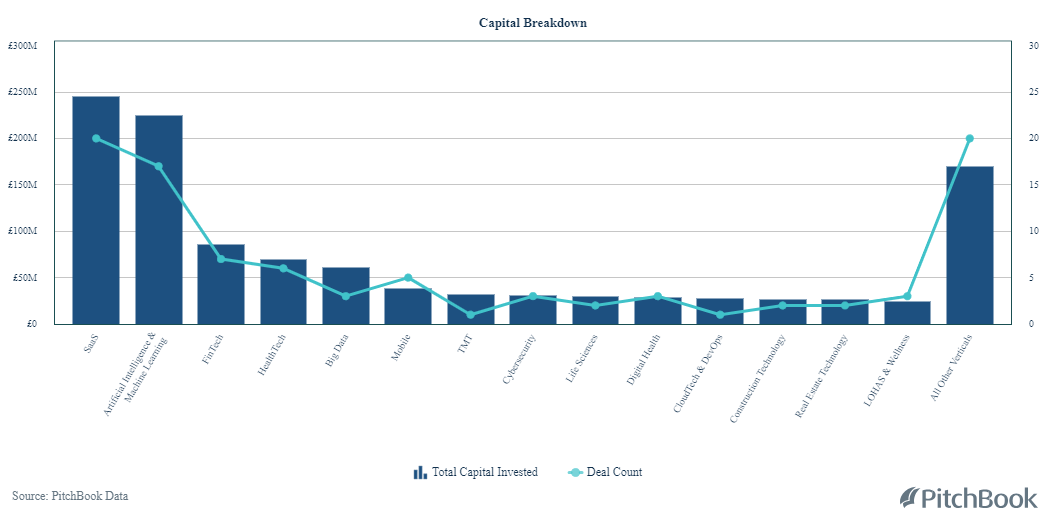

Across the pond in New York, the funding landscape flipped.

Here, SaaS and AI led the pack in total capital investment—but they also had a high deal count, showing strong, widespread investor interest. In contrast, Life Sciences and Digital Health saw lower activity both in deal numbers and total funding, signaling a quieter month for these industries.

Investment size varies widely by sector. Healthcare and biotech demand massive funding rounds due to high R&D costs and regulatory challenges, while tech sectors like SaaS and AI attract frequent but smaller investments, letting investors spread their bets across multiple startups.

Will this trend continue, or will we see a shift in where the big money flows next?

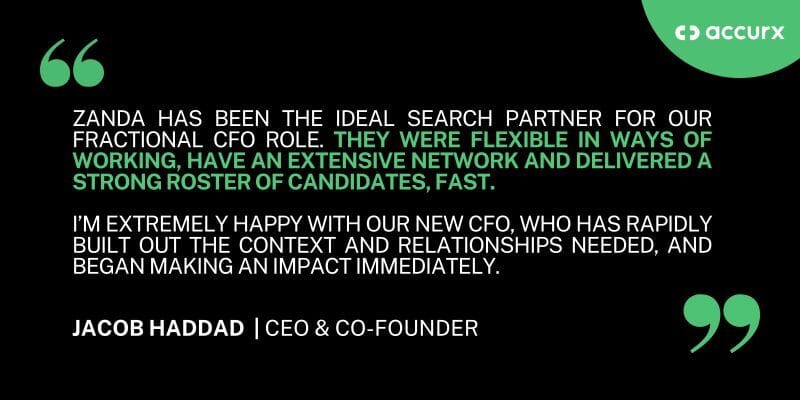

Testimonial

Flexible, efficient and well connected 😎

Those are definitely three words every executive search firm wants to be described as! Thank you Jacob Haddad for finishing our week with this glowing review.

It was a pleasure to support Accurx with their Fractional CFO requirement and we're excited to see the ongoing impact Andrew P. makes.

If you require similar fractional finance support, get in touch here.

Current Opportunities

In this episode we have highlighted just a handful of our newest jobs, if you would like to apply for any of these roles please send an email to [email protected]

If you have a similar role you are currently recruiting for, register your vacancy here!